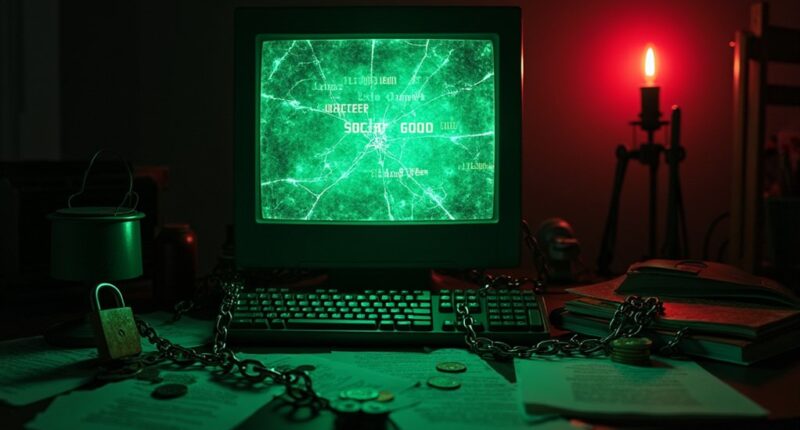

Privacy coins, champions of financial anonymity, are under siege by regulators who, with brazen hypocrisy, vilify them as criminal tools while cash—equally untraceable—escapes such scorn. Their untraceable nature, powered by zero-knowledge proofs, infuriates Anti-Money Laundering efforts, triggering bans in Japan, South Korea, and delistings on exchanges. Systemic risks, slashed liquidity, and legal quagmires haunt users, yet isn’t privacy a right? Stick around to uncover the deeper clash between confidentiality and control.

How can a technology promising unparalleled financial privacy be so relentlessly vilified, cast as the villain in the global fight against crime? Privacy coins, designed to shield transactions from prying eyes, are under siege, branded as tools for money laundering, tax evasion, and worse. Governments and regulators, in their unyielding quest for control, slap on Global Bans—think Japan and South Korea—claiming these coins threaten the financial system. But isn’t this a grotesque overreach, stomping on User Privacy while hiding behind the flimsy excuse of “public safety”? The hypocrisy stinks; after all, cash, the ultimate anonymous tool, isn’t outlawed, is it?

Scrutiny intensifies as these coins, with their untraceable nature, frustrate Anti-Money Laundering and Countering Financing of Terrorism efforts, leaving regulators frothing at the mouth. They argue systemic risks loom large, tarnishing the crypto ecosystem’s reputation, yet where’s the hard evidence quantifying this supposed chaos? Instead, exchanges delist privacy coins, cowering under compliance threats, slashing liquidity and access. Investors, predictably, shy away from the legal quagmire, while users grapple with a shrinking ecosystem—hardly a glowing endorsement of innovation, wouldn’t you agree? Privacy coins, despite their benefits, face significant hurdles due to their potential misuse in illicit activities, complicating widespread adoption potential misuse.

Meanwhile, the FATF Travel Rule mocks privacy tech, demanding transaction transparency that these coins, by design, obliterate. U.S. actions, like banning mixing services, scream overkill, as if privacy itself is a crime. Additionally, the FATF’s stringent guidelines push for Travel Rule compliance, forcing virtual asset service providers to share transaction data, further eroding the anonymity privacy coins strive to protect. And the technical wizardry—zero-knowledge proofs, ring signatures—while brilliant, baffles the average user, inviting exploitable flaws if not rigorously audited. So, who’s accountable when security fails? The tension between privacy rights and regulatory demands festers, unresolved, as advocates of financial confidentiality clash with transparency zealots. Isn’t it time to stop demonizing a tool and start addressing the root of illicit finance—human greed, not code? Moreover, the clash between anonymity and regulatory demands creates a complex landscape where privacy coins struggle to balance user confidentiality with legal compliance anonymity clash.

Frequently Asked Questions

What Are the Most Popular Privacy Coins Today?

Examining the landscape of digital currencies, one finds the most popular privacy-focused coins leading in Coin Rankings. Monero, Zcash, and Dash dominate, reflecting high Adoption Rates among users seeking enhanced transactional anonymity and security.

How Do Privacy Coins Enhance User Anonymity?

User anonymity is enhanced through advanced cryptographic methods. Techniques like Zero Knowledge proofs conceal transaction details, while Ring Signatures obscure origins by mixing keys. These mechanisms guarantee privacy and protect identities effectively on blockchains.

Are Privacy Coins Legal in All Countries?

Regarding global legality, the status of certain cryptocurrencies varies widely. Some nations permit their use, while others impose regional bans, reflecting diverse approaches to regulation and concerns over potential misuse in financial systems.

Can Privacy Coins Be Traced by Authorities?

Authorities can trace certain transactions using advanced Tracing Methods to uncover hidden patterns. With specialized Authority Tools, they analyze data and detect anomalies, aiding in investigations despite challenges posed by obfuscation technologies.

Why Do Privacy Coins Face Public Scrutiny?

Public scrutiny often arises from ethical debates surrounding anonymous financial tools, questioning their potential misuse. Media influence amplifies these concerns, shaping public opinion by highlighting risks and fueling discussions on accountability and transparency.