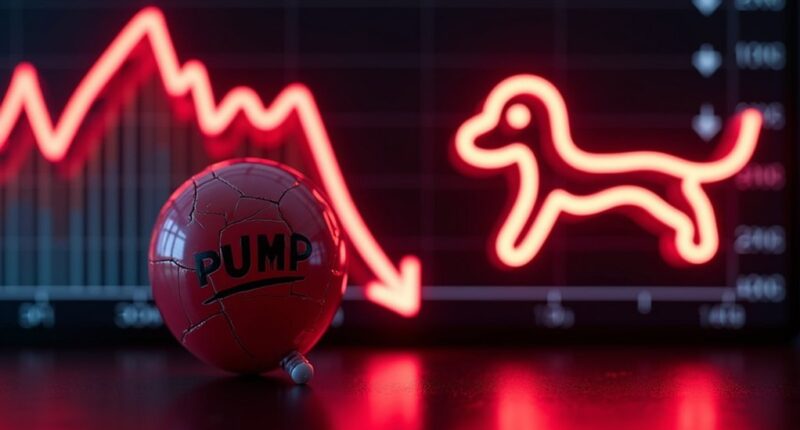

Although hailed as a blockbuster success with $448.5 million raised from a frenzied ICO, the PUMP token’s spectacular 22% nosedive within 24 hours exposes the stark disconnect between hype and reality, laying bare the superficial frenzy that propelled it; buoyed briefly by a $30 million buyback effort and a fleeting surge past $0.0068, the token now languishes 20% below its initial offering price, undermining any illusion of sustainable demand and spotlighting the reckless exuberance that too often characterizes crypto launches devoid of tangible utility or investor confidence. The token’s initial spike to an all-time high of approximately $0.006812, fueled by a staggering $1.1 billion trading volume, was nothing more than a mirage, evaporating swiftly as the market reeled from an inevitable correction. The precipitous drop to about $0.00406 not only erased early gains but revealed the fragility of a market buoyed on hype rather than substantive value. Despite the huge trading volume, key support zones failed to hold, with bulls unable to defend the price.

Investor sentiment turned sour with nearly 60% offloading their holdings, a mass exodus that no buyback initiative could arrest, as sell orders overwhelmed the exchanges—OKX, BitMEX, Kraken, and KuCoin—where PUMP was listed. The token’s lack of practical utility, despite promises tied to the PumpSwap protocol, left early backers clutching an overvalued asset stripped of meaningful function. This glaring absence of value proposition transformed speculative enthusiasm into panic selling, underscored by a 16% plunge in futures open interest, signaling waning speculative appetite.

Ultimately, PUMP’s freefall serves as a cautionary tale of the crypto market’s vulnerability to hype-fueled launches bereft of genuine investor trust or economic fundamentals, illustrating how rapidly inflated valuations can implode under the weight of their own inflated expectations.